SMS compliance: Protecting your business in a regulated world

Why SMS still matters for regulated industries In today’s evolving digital landscape, SMS remains one of the most effective and…

Discover how Convey solves problems and fulfills needs.

Message Broadcast rebrands as Convey, marking a

Read More

Message Broadcast rebrands as Convey, marking a

Read More

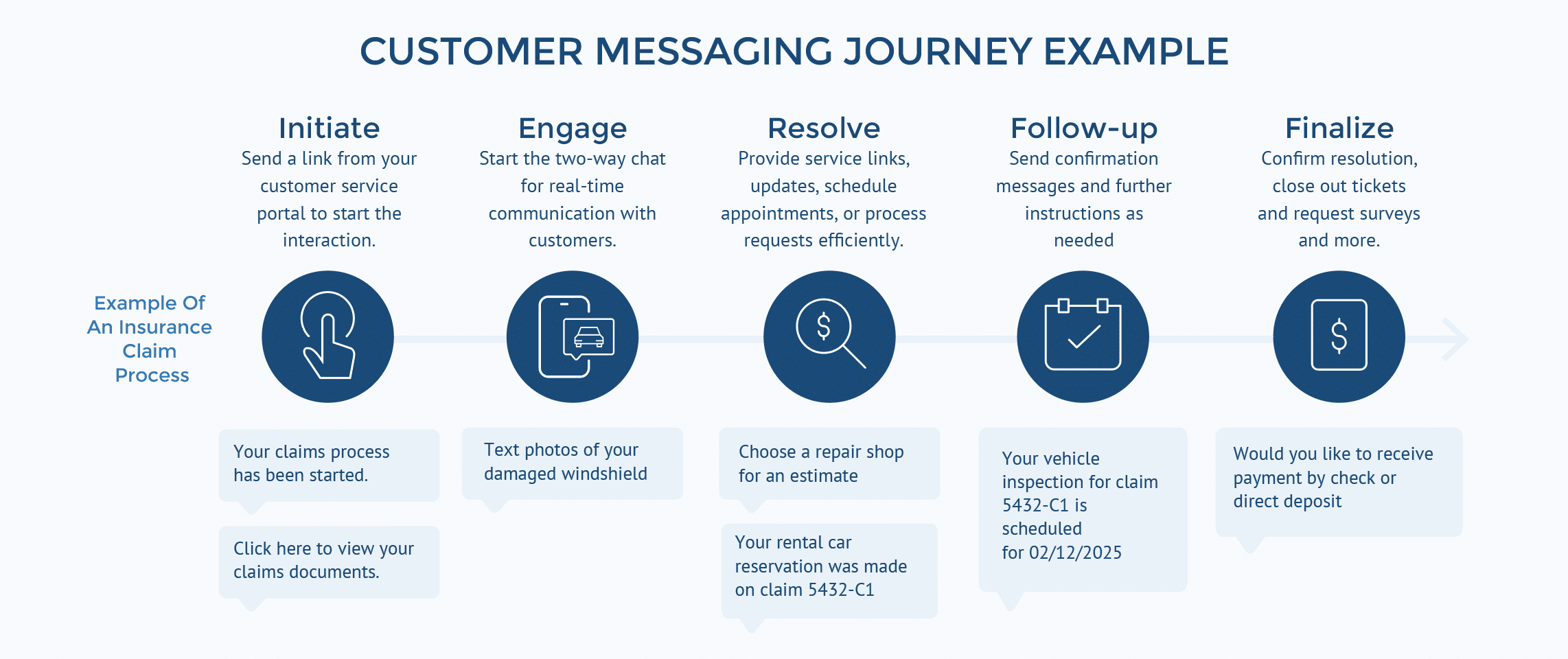

Despite the proliferation of digital communication channels, SMS and MMS messaging remain unrivaled in connecting people.¹ These time-tested technologies offer unparalleled reach and engagement. With new and innovative applications of SMS and MMS, there is a growing revolution in the insurance claims process, enabling a seamless journey from claim initiation to resolution.

Insurance companies are harnessing the power of these familiar yet potent tools to streamline operations, enhance customer satisfaction, and set new benchmarks for industry excellence. By leveraging the ubiquity and immediacy of text messaging, insurers are transforming how claims are processed, communicated, and resolved. This approach improves operational efficiency and meets the growing consumer demand for quick, convenient, and transparent interactions.

The evolution of SMS and MMS in insurance claims management demonstrates that the most effective solutions are sometimes built upon established technologies and reimagined for modern challenges. These messaging services are the cornerstone of a more responsive, efficient, and customer-centric claims process.

According to a study by J.D. Power, insurers that increased their claims processing speed saw a significant rise in customer retention rates². The study found that overall satisfaction with the auto insurance claims process increased to a record-high 872 (on a 1,000-point scale), up four points from 2019. This study demonstrates the direct correlation between efficient claims handling and customer satisfaction. SMS and MMS messaging can play a crucial role in achieving this efficiency.

Aerialink, a leading provider of enterprise messaging solutions, offers a robust platform that enables insurance companies to leverage the benefits of text messaging throughout the claims journey. SMS and MMS can keep customers informed and engaged from the start of the claim initiation to its final resolution.

Here’s how Aerialink’s SMS and MMS messaging solutions can simplify each step of the claims process:

SMS and MMS text messages have a higher response rate, with an open rate of nearly 95%³ within three minutes of receipt, surpassing email, and phone calls. SMS and MMS also reduce the need for lengthy phone calls and paperwork, saving time and resources for both insurers and policyholders. This results in cost savings. Coupled with their ability for quick and transparent communication throughout the claims process, with easy document sharing, SMS and MMS can significantly reduce the time it takes to process and resolve claims, further garnering improved customer satisfaction and loyalty.4

Aerialink’s enterprise messaging platform is at the forefront of this revolution in insurance communications. It enables insurance companies to:

By leveraging Aerialink’s advanced messaging capabilities, insurance companies can transform their claims process, improve operational efficiency, and enhance customer experiences.

The insurance industry is on the cusp of a communication revolution, with SMS and MMS messaging leading the way. These technologies are transforming the claims process while fostering stronger insurer-policyholder relationships. With Aerialink’s enterprise messaging platform alongside AI and IoT capabilities, insurers can deliver personalized, timely interactions that exceed customer expectations.

The impact on operational efficiency and costs is significant. With more than 80% of agents ranking insurer connectivity as essential, adopting these technologies is cost-effective and competitively necessary. The J.D. Power study highlighted that insurers who improved their service delivery saw direct improvements in business outcomes4, including higher customer satisfaction and increased intent to renew. Aerialink’s solution enables insurers to streamline communication processes, potentially saving millions in operational expenses.

Organizations that embrace SMS and MMS messaging will increase customer satisfaction and operational excellence. Aerialink’s innovative platform empowers insurers of all sizes to navigate this digital transformation confidently, setting new standards for customer-centric communication while realizing substantial cost savings and positioning themselves as leaders in an increasingly digital insurance market.

Interested in discussing how Aerialink can revolutionize the way providers communicate with their customers? Schedule time today!

Read other insights and news from the Convey team.

Why SMS still matters for regulated industries In today’s evolving digital landscape, SMS remains one of the most effective and…

Convey’s new website, goconvey.com, advances utility customer engagement Convey has unveiled its new website, goconvey.com, marking the next chapter in…

CLIENT: Leading utility company USE CASE: Outage management THE CHALLENGE In late 2022, a large utility in the Southern US…

Loading...