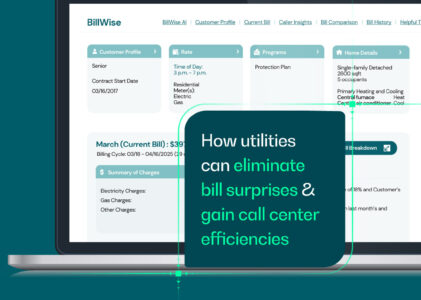

On-demand webinar: How utilities can eliminate bill surprises & gain call center efficiencies

As energy costs fluctuate and customer expectations rise, utilities are under increasing pressure to deliver predictable bills, proactive communication, and…